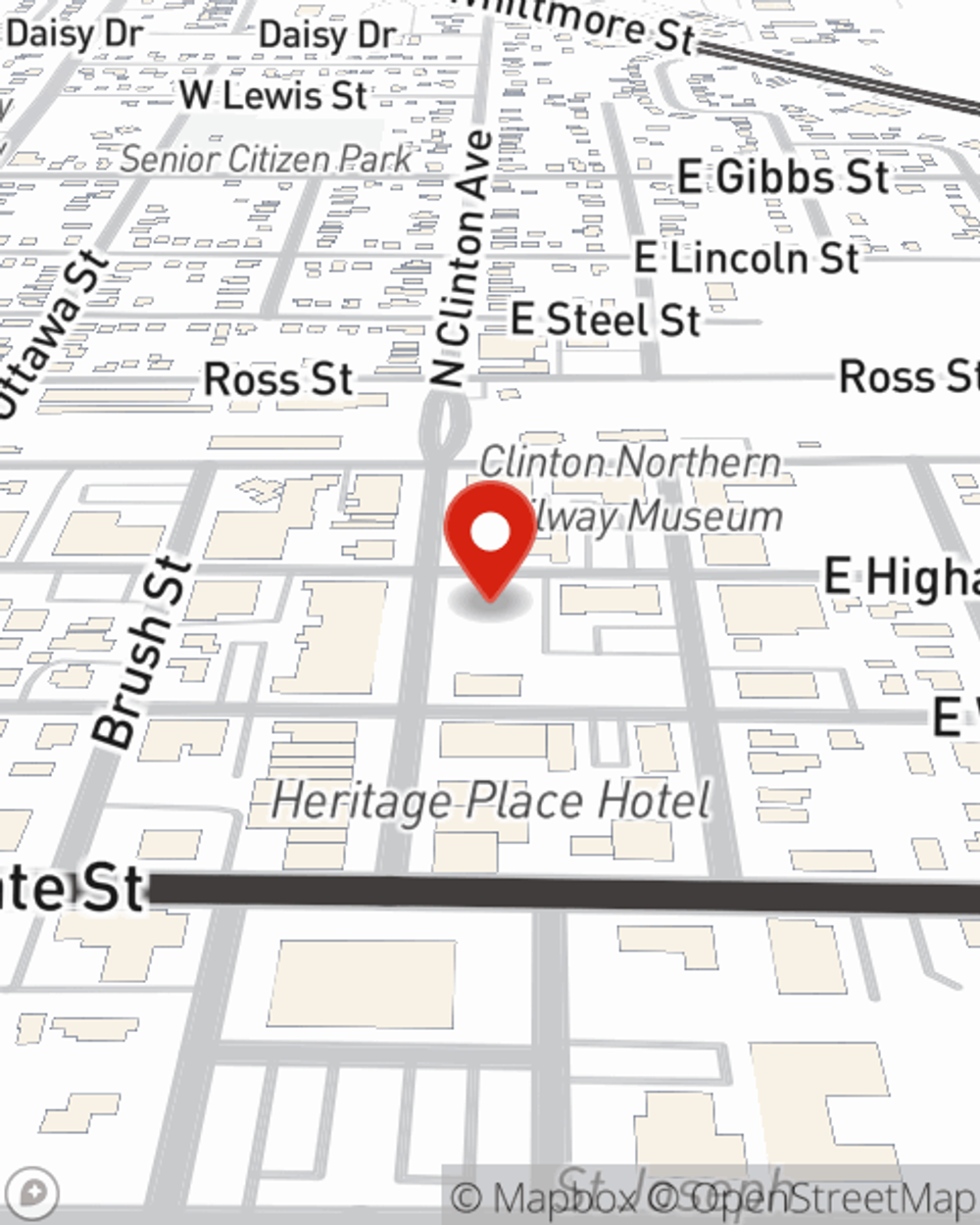

Business Insurance in and around Saint Johns

Get your Saint Johns business covered, right here!

No funny business here

- St. Johns

- Ovid

- Elsie

- Ashley

- Fowler

- Pewamo

- Westphalia

- Ithaca

- Dewitt

- Muir

- Bath

- Laingsburg

- Clinton County

- Ingham County

- Eaton County

- Montcalm County

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, business continuity plans and errors and omissions liability, you can take a deep breath knowing that your small business is properly protected.

Get your Saint Johns business covered, right here!

No funny business here

Protect Your Future With State Farm

When you've put so much personal interest in a small business like yours, whether it's an art gallery, a lawn care service, or a farm supply store, having the right protection for you is important. As a business owner, as well, State Farm agent Steve VanElls understands and is happy to help with customizing your policy options to fit what you need.

Ready to explore the business insurance options that may be right for you? Get in touch with agent Steve VanElls's office to get started!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Steve VanElls

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.